Introduction to Parametric Cyclone Insurance

Parametric cyclone insurance represents an innovative approach to managing cyclone-related risks, particularly in a climate-vulnerable region like Australia. Unlike traditional insurance models, which indemnify the insured for the loss suffered, parametric insurance provides payouts based on the occurrence of predefined events, such as a cyclone reaching a specific intensity or location. This structure offers several strategic advantages, especially in the context of the frequent and severe cyclonic activity experienced in Australia.

Parametric insurance products are gaining traction globally due to their efficiency and adaptability. CelsiusPro Australia, a leader in this field, is at the forefront of offering parametric cyclone insurance tailored to the unique challenges of the Australian market. This article delves into the strategic benefits of parametric cyclone insurance, contrasting it with traditional models, and exploring how it enhances risk management and financial resilience.

Summary

1. Traditional vs. Parametric Insurance

a. Traditional Cyclone Insurance Explained

Traditional cyclone insurance typically provides coverage based on the actual damages sustained by an insured party due to a cyclone event. The process involves an extensive claims assessment, where an insurer evaluates the extent of the damage before determining the payout. This model has been the standard for decades, but it has notable limitations, particularly in terms of the time and complexity involved in claims processing.

b. Parametric Cyclone Insurance Explained

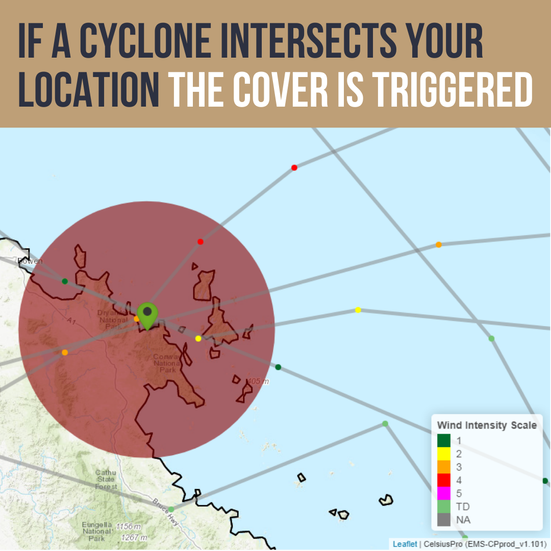

In contrast, parametric cyclone insurance operates on a pre-agreed trigger system. For instance, if a cyclone with a wind speed exceeding 150 km/h hits a certain geographic area, the policyholder automatically receives a payout. The payout is determined in advance based on parameters such as wind speed, cyclone category, or rainfall intensity, regardless of the actual damages incurred.

c. Key Differences between Traditional and Parametric Insurance

The primary difference lies in the speed and certainty of payouts. Traditional insurance can take weeks or even months to process claims, whereas parametric insurance offers near-instantaneous payouts. Additionally, parametric insurance reduces the potential for disputes since the payout criteria are objective and predefined.

Traditional Insurance | Parametric Insurance |

Proof of loss is required | No proof of loss is required |

Excess on payouts | No excess needs to be paid |

Lengthy Claims Process | No Claiming Procedures |

Payouts are subjective based on damages | Payouts are Automatic and quantitative |

2. How Parametric Cyclone Insurance Works

a. Trigger Events and Payout Mechanisms

Parametric cyclone insurance relies on specific trigger events, such as the cyclone's intensity or the affected area. These triggers are set based on historical data and predictive models, ensuring that they are both realistic and relevant. Once the trigger event occurs, the payout process is initiated automatically, bypassing the need for loss assessments.

b. The Role of Cyclone Data in Parametric Insurance

Accurate and timely cyclone data is crucial for parametric insurance. Advanced meteorological technology, including satellite monitoring and remote sensors, plays a pivotal role in tracking cyclone movements and intensity. This data feeds into the parametric models, ensuring that triggers are based on real-time, reliable information.

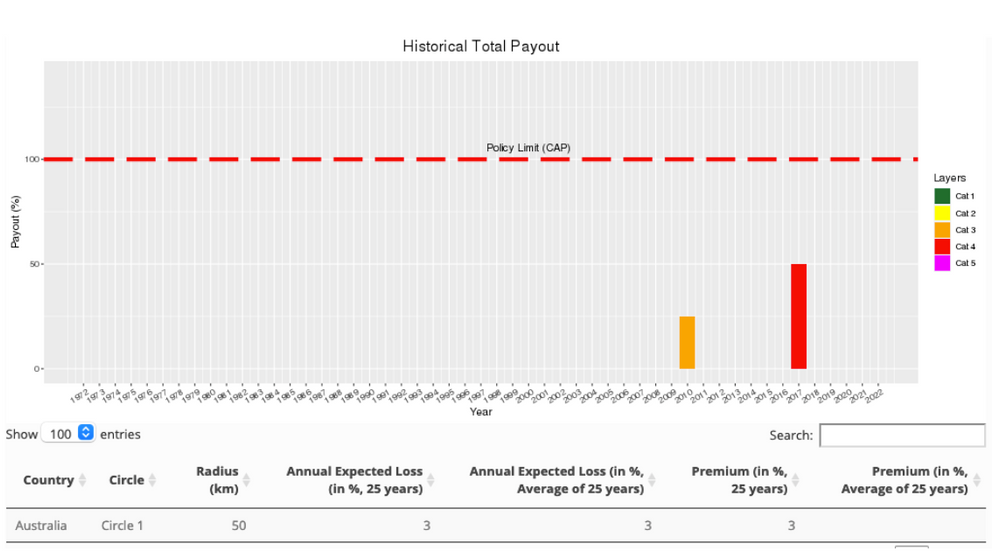

c. Calculation of Payouts and Transparency

The calculation of payouts in parametric insurance is transparent and straightforward. Since the payout is linked to specific, measurable parameters, policyholders have clarity on the potential outcomes from the outset. This transparency not only enhances trust but also allows for better financial planning and risk management.

3. Strategic Advantages of Parametric Cyclone Insurance

a. Speed of Payouts

One of the most significant advantages of parametric cyclone insurance is the speed of payouts. In the wake of a cyclone, quick access to funds is critical for businesses and communities to start the recovery process. Parametric insurance can provide payouts within days, significantly reducing the financial strain and uncertainty that often accompany disaster recovery.

b. Flexibility in Coverage

Parametric insurance offers flexibility that traditional models cannot match. Policies can be tailored to cover specific risks, such as extreme wind speeds or heavy rainfall, allowing businesses to align their insurance coverage more closely with their unique risk profiles.

c. Reduced Claims Disputes

By removing the subjective element of loss assessment, parametric insurance minimizes the likelihood of claims disputes. Since payouts are based on clearly defined parameters, both the insurer and the insured have a mutual understanding of when and how payouts will occur.

d. Enhancing Financial Planning and Liquidity

With predefined payouts, parametric insurance enables better financial planning. Businesses and governments can allocate resources more efficiently, knowing exactly what funds will be available post-event. This certainty is crucial for maintaining liquidity and ensuring that recovery efforts are not hampered by financial constraints.

4. Risk Management and Resilience Building

a. Strengthening Community Resilience

Parametric cyclone insurance contributes to stronger community resilience by providing a reliable financial safety net. Quick payouts ensure that recovery efforts can begin immediately, reducing the long-term economic and social impacts of cyclones.

b. Supporting Sustainable Development Goals (SDGs)

The role of parametric insurance in supporting the Sustainable Development Goals (SDGs) is increasingly recognized. By mitigating the financial impact of cyclones, parametric insurance supports goals related to poverty reduction, economic growth, and resilient infrastructure.

c. Reducing Economic Impact on Businesses and Governments

For businesses and governments, the economic impact of cyclones can be devastating. Parametric insurance helps mitigate these effects by providing quick access to funds, ensuring that economic activities can resume as swiftly as possible. This is particularly vital for sectors like agriculture, tourism, and manufacturing, which are often hardest hit by cyclones.

5. Market Applications of Parametric Cyclone Insurance

a. Applications for Government and Public Sector

Governments can use parametric cyclone insurance to protect public infrastructure and services. By ensuring rapid payouts, governments can maintain critical services and rebuild infrastructure faster, reducing the long-term economic impact of cyclones.

b. Applications for Corporate and Commercial Entities

For corporations, parametric insurance provides a strategic tool to manage risks associated with cyclones. This is particularly relevant for businesses with significant assets in cyclone-prone areas, such as mines, ports, and manufacturing plants.

c. Impact on Agricultural Sector

The agricultural sector, which is highly vulnerable to cyclonic events, can greatly benefit from parametric insurance. Farmers and agribusinesses can secure their livelihoods against extreme weather events, ensuring that they can recover quickly and continue operations.

d. Reinsurance and Parametric Products

Reinsurers are increasingly adopting parametric products as part of their risk management strategies. These products allow for better capital allocation and risk diversification, making them a valuable addition to traditional reinsurance portfolios.

Conclusion

a. Summary of Strategic Advantages

Parametric cyclone insurance offers several strategic advantages over traditional models, including faster payouts, flexibility, and reduced claims disputes. These benefits make it an attractive option for businesses and governments in cyclone-prone regions like Australia.

b. The Role of Parametric Insurance in Australia's Future

As Australia continues to face the challenges of climate change, parametric insurance will play a crucial role in enhancing resilience and financial stability. By offering a reliable and efficient way to manage cyclone risks, parametric products are set to become a key component of Australia's insurance landscape.

c. Final Thoughts on Adoption and Implementation

The adoption of parametric cyclone insurance in Australia represents a significant step forward in risk management. With the support of innovative providers like CelsiusPro Australia, this insurance model is poised to offer substantial benefits to businesses, governments, and communities across the country.

If you want to look into purchasing CelsiusPro's Cyclone Rapid Recovery Insurance (CRRI), feel free to book a consultation with an expert today or request a copy of our Information Pack using the buttons below.